Chase Secure BankingSMA simple checking account with no overdraft fees2

$4.95 or $0 Monthly Service Fee3

You can avoid the fee with $250+ in qualifying electronic deposits each monthly statement period.4

Read Additional Banking Services and Fees (PDF)

for more information.

Not sure? CompareSame page link to Compare Accounts section your options.

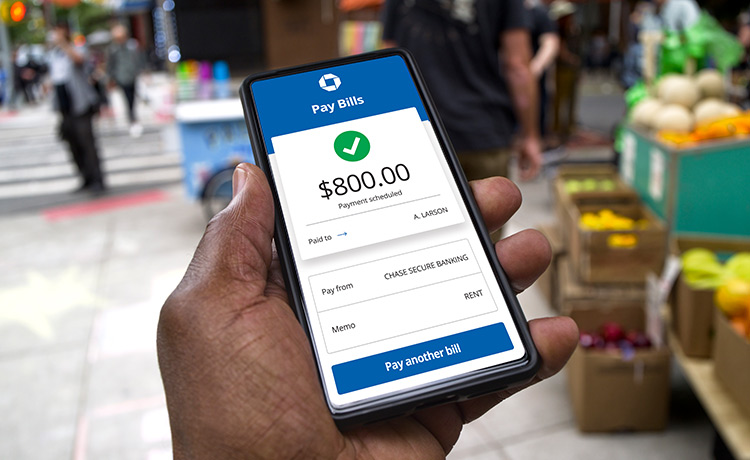

Manage your money, deposit checks and pay bills or people

from virtually anywhere, all with the Chase Mobile® app.5

The advantage for me is that the account does not allow you to go into an overdraft and charge fees.”

- Natalie V.10

Participants are compensated for their survey participation.

No fees on most everyday transactions

Secure Banking customers told us they save an average of more than $40 a month on fees after opening their account.6

- Check mark iconNo overdraft fees,2 spend only what you have

- Check mark iconNo fees on money orders or cashier’s checks

- Check mark iconNo fees when you cash checks, send money using Zelle®7 or use a Chase ATM8

- Check mark iconNo fees to pay bills with Chase OnlineSM Bill Pay9

Designed for your

peace of mind

With Chase Credit Journey®, help build and improve your credit with a personalized improvement plan provided by ExperianTM.11

Get that "just paid" feeling up to two business days sooner with early direct deposit.1

Get reimbursed for unauthorized debit card transactions when reported promptly with

Zero Liability Protection.12

Manage your spending with Spending Planner13 and get daily spending insights with Snapshot in the Chase Mobile® app.

and alerts

Check your balance, pay bills, deposit checks with the Chase Mobile® app. Plus, set up alerts to monitor your balance, deposits and more.14

Lock and unlock your debit

card if you misplace it.

Banking that grows with your family

From the first day of school to college graduation, Chase meets your student where they are in their financial journey:

- Check mark iconTeach your child money basics with Chase First BankingSM

- Check mark iconEmbark on financial independence with Chase College CheckingSM

Plus, set them up with a Chase SavingsSM account to start building healthy saving habits.

Get started with

Chase Secure BankingSM

No minimum deposit to get started.

Not sure? CompareSame page link to Compare Accounts section your options.

Already a Chase Secure Banking customer?

Make the most of your account.

Learn how

Certified low-cost account

Chase Secure Banking has been certified by Bank On for meeting the National Account Standards as a low-cost, low-fee account since 2019.

Monthly Service Fee3

Monthly Service Fee3

$4.95 or $0

Avoid feeopens overlay

$15 or $0

Avoid feeOpens overlay

Early direct deposit - with direct deposit, get your money up to two business days early1

Early direct deposit - with direct deposit, get your money up to two business days early1

Available

Not Available

No fees for money orders and cashier’s checks

No fees for money orders and cashier’s checks

Available

Not Available

Overdraft services

Overdraft services

Spend only the money you have available, without worrying about overdraft fees.2

Available

Paper checks

Paper checks

Not Available

Available

Wire transfers (incoming and outgoing)

Wire transfers (incoming and outgoing)

Not Available

Available

Bank on your terms — online, on the go with the mobile app, or in person at 5,000 branches and 15,000 ATMs

Bank on your terms — online, on the go with the mobile app, or in person at 5,000 branches and 15,000 ATMs

Available

Available

Chase Secure BankingSM

Other fees apply. See account details.

Chase Total Checking®

Other fees apply. See the Clear & Simple Product Guide (PDF) for more information.

FAQs

Learn more about Chase Secure Banking by

reading our frequently asked questions:

Chase Secure Banking is a simple, convenient checking account with no overdraft fees and requires no minimum deposit to get started. Moreover, there are no fees on most everyday transactions like money orders, cashier’s checks, when you cash checks, send money using Zelle® or use a Chase ATM.

- You can download the Chase Mobile app and manage your money, deposit checks and pay bills or people from virtually anywhere.

- With Chase Secure Banking get that “just paid” feeling up to two business days sooner with early direct deposit.

- Chase Secure Banking is a simple checking account and paper checks, overdraft services, and incoming or outgoing wire transfers are not included.

With Chase Secure Banking, you can receive your eligible direct deposits up to two business days early. If you're already set up for direct deposit, you'll be automatically enrolled. If you haven't set it up yet, you'll need to set up direct deposit to your account.

There are no overdraft fees with a Chase Secure Banking account. We help you spend only what you have without worrying about overdraft fees.

You can avoid the $4.95 Monthly Service Fee when you have electronic deposits made into this account during each monthly statement period totaling $250 or more, such as direct deposits or payments from payroll providers or government benefit providers.

1 For Chase Secure CheckingSM only: Early direct deposit is a service that comes with your Chase Secure Checking account in which we credit your eligible direct deposit transaction up to two business days early. You must set up direct deposit to your account. The timing of when these transactions will be credited is based on when the payer submits the information to us. This means when these transactions are credited could vary and you may not receive your funds early. Eligible transactions are certain ACH credit transactions such as payroll, government benefits or similar transactions.

2 We will decline or return transactions when you do not have enough money in your account to cover the charge. However, you could still end up with a negative balance if, for example, a transaction is approved for one amount, but then the actual charge is more than what you have in your account (like when you add a tip at a restaurant after the transaction for the meal was already approved). Even if you have a negative balance, we will not charge you an overdraft fee.

3 New and converted accounts will not be charged a Monthly Service Fee for at least the first two statement periods. After that the Monthly Service Fee will apply unless you meet one of the ways to avoid the Monthly Service Fee each statement period (if applicable).

4 Chase Secure BankingSM: $0 Monthly Service Fee when you have $250+ in qualifying electronic deposits. Qualifying electronic deposits include payments from your employer or government entities (benefits, tax refunds, etc.), made using the ACH network, Real Time Payment (RTP®), FedNow® Service, or third-party services that facilitate payments to your debit card using the Visa® or Mastercard® network. Transactions such as Zelle®, cash, checks, wire transfers, and interest payments do not count as qualifying electronic deposits. Otherwise a $4.95 Monthly Service Fee will apply.

Product terms subject to change. For more information, please see a banker or visit chase.com/checking.

5 Chase Mobile® app is available for select mobile devices. Enroll in Chase OnlineSM or on the Chase Mobile app. Deposits made through the Chase Mobile app are subject to deposit limits and funds are typically available by next business day. Deposit limits may change at any time. Other restrictions apply. See chase.com/QuickDeposit or the Chase Mobile app for eligible mobile devices, limitations, terms, conditions and details. Message and data rates may apply.

6 Savings represents the average monthly reported savings on fees for money orders, check cashing, U.S. remittances, prepaid debit cards, and bill paying services by 1815 Chase Secure Banking customers who responded to a Chase survey fielded in May and June 2025. The responses represent 0.067% of the total population of Chase Secure Banking customers. Your savings may vary.

7 Enrollment in Zelle® at a participating financial institution using an eligible U.S. checking or savings account is required to use the service. Chase customers may not enroll using savings accounts; an eligible Chase consumer or business checking account is required, and may have its own account fees. Consult your account agreement. Funds are typically made available in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle® (go to enroll.zellepay.com to view participating banks). Select transactions could take up to 3 business days. Enroll on the Chase Mobile® app or Chase OnlineSM. Limitations may apply. Message and data rates may apply.

Zelle® is intended for payments to recipients you know and trust and is not intended for the purchase of goods from retailers, online marketplaces or through social media posts. Neither Zelle® nor Chase provide protection if you make a purchase of goods using Zelle® and then do not receive them or receive them damaged or not as described or expected. In case of errors or questions about your electronic funds transfers, including information on reimbursement for fraudulent Zelle® payments, see your account agreement. Neither Chase nor Zelle® offers reimbursement for authorized payments you make using Zelle®, except for a limited reimbursement program that applies for certain imposter scams where you sent money with Zelle®. This reimbursement program is not required by law and may be modified or discontinued at any time.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

8 You may be charged fees for using non-Chase ATMs by both Chase and the ATM owner/network (Surcharge Fees). See the Deposit Account Agreement for details.

9 Chase Online Bill Pay: Must enroll in Chase OnlineSM Banking and activate Online Bill Pay. Certain restrictions and limitations may apply.

10 The Testimonials on this page or provided via linked videos are the sole opinions, findings or experiences of our customer and not those of JPMorgan Chase Bank, N.A. or any of its affiliates. These opinions, findings, or experiences may not be representative of what all customers may achieve. JPMorgan Chase Bank, N.A. or any of its affiliates are not liable for decisions made or actions taken in reliance on any of the testimonial information provided.

11 This score improvement resource does not guarantee you will reach your credit score goal even if you complete the recommended actions, as there are other factors that may impact your VantageScore. This resource should be used for educational purposes only. There are various types of credit scores that lenders can access to make a lending decision. The credit score you receive is based on the VantageScore® 3.0 model and may not be the credit score model used by your lender or by Chase. You should carefully consider your needs and objectives before making any decisions, and consult the appropriate professional(s).

12 Special Provisions for Card Transactions (Zero Liability Protection): Chase will reimburse unauthorized debit card transactions when reported promptly. Certain limitations apply. See Deposit Account Agreement for details.

13 Spending Planner is meant to help you track and manage your spending, and is based on posted transactions within your Chase accounts. It may not include all your financial activity, such as other sources of income or external transactions. The numbers we provide are updated throughout the day, but are subject to adjustment and correction; consider your full financial picture when making decisions.

14 Account Alerts: There's no charge from Chase, but message and data rates may apply. Delivery of alerts may be delayed for various reasons, including service outages affecting your phone, wireless or internet provider; technology failures; and system capacity limitations. Any time you review your balance, keep in mind it may not reflect all transactions including recent debit card transactions.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC.