Chase First BankingSM

A debit card for kids

- No Monthly Service FeeSame page link to footnote reference1

- Designed for kids ages 6-12, available for ages 6-17

- Banking account owned and managed by you

- Exclusively for Chase checking customers

Not a Chase checking customer? Explore Accounts Opens in a new window

Account subject to approval

Unlock their world with a debit card of their own

Their card, your guidance. With Chase First Banking, your kids will be on the path to learning financial responsibility.

Stay in the know with limits and alerts

Set limits on where and how much they can spend or withdraw from ATMs. Plus, Account AlertsSame page link to footnote reference2 help you keep track of their purchases.

Security features for peace of mind

Teach your kids money skills with confidence using security features like secure sign-in via the Chase Mobile® app.Same page link to footnote reference3

Power up your kid’s money confidence

Check out what Chase First Banking

customers are saying

CHILD

“It is very cool to have my own debit card with my name and then I can pay for my own things without my parents' card.”

PARENT

“I really love that I am able to start teaching my child about banking, saving, earning, and spending.”

Participants are compensated for their survey participation.

Banking that grows with your family

From the first day of school to college graduation, Chase meets your student where they are in their financial journey:

- Teach your child money basics with Chase First BankingSM

- Send money to friendsSame page link to footnote reference5 and get direct deposits with Chase High School CheckingSM Opens in a new window

- Embark on financial independence with a Chase College CheckingSM Opens in a new window account

Plus, set them up with a Chase SavingsSM Opens in a new window account to start building healthy saving habits.

Ready to get your kids started with their first debit card?

You'll first need to have a qualifying Chase checking account before you can add a Chase First Banking account. Designed with kids ages 6-12 in mind and available for kids ages 6-17.Same page link to footnote reference1 Chase First Banking has a $0 Monthly Service Fee.

Account subject to approval. See Additional Banking Services and Fees (PDF) opens in a new window for more information.

Have a Chase checking account?

Open a Chase First Banking account for your children

Not a Chase checking customer?

Choose the checking account that’s right for you

Got questions? We’ve got answers.

Chase First Banking is a banking account for kids opened by parents that helps families digitally manage spending and provides opportunities for kids to learn and practice the basics of personal finance by using a debit card in their name. It can be accessed virtually anywhere with the Chase Mobile® appSame page link to footnote reference3 or on chase.com.

Chase First Banking accounts come with a number of unique features for both parents and kids.

Parents can:

- Choose where and how much their child can spend in stores and online

- Create kids’ allowances

- Assign chores

- Receive activity-related account alertsSame page link to footnote reference2

- Set limits on where and how much their child can spend or withdraw from ATMs

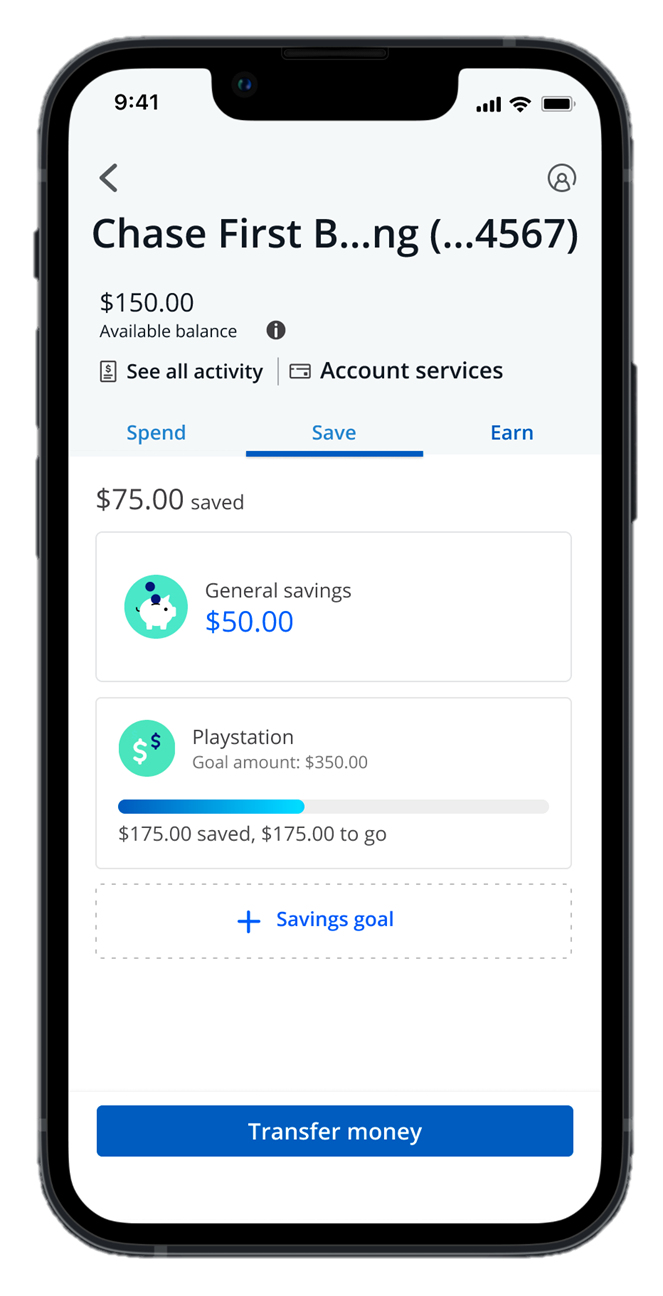

And kids can:

- Use their debit card to make purchases at stores and online

- Track their balances and transactions with the Chase Mobile® app

- Create savings goals

- Withdraw money from ATMs using their Chase First Banking debit card (at participating non-Chase ATMs, fees from Chase and the ATM owner still apply)

- Learn how to manage their money in real-world scenarios

Chase First Banking is available for kids ages 6-17 and designed with kids ages 6-12 in mind.

No, Chase First Banking does not have a direct deposit option. Chase High School Checking, an account for teens ages 13-17 that includes direct deposit and check writing, may be a better option. To learn more, visit Chase High School CheckingSM Opens in a new window.

You need to be a Chase checking customer to open a Chase First Banking account. Chase First Banking accounts must be linked to a qualifying Chase checking account.

Qualifying accounts include: Chase Secure CheckingSM Opens in a new window, Chase Total Checking® Opens in a new window, Chase Premier Plus CheckingSM Opens in a new window, Chase SapphireSM Checking Opens in a new window, or Chase Private Client CheckingSM Opens in a new window. Benefits offered to these checking accounts do not apply to Chase First Banking accounts.

Anyone can open an account online or schedule a meeting Opens in a new window at a Chase branch. If you are a current Chase customer, you can also use your Chase Mobile® app to open an account today. Need help deciding? Compare our checking account options here Opens in a new window.

No, Chase First Banking does not support peer-to-peer transactions like those using Zelle®, Venmo®, PayPal® or Cash AppTM. Additionally, the account’s debit card cannot be added to fund these types of transactions.

Still have questions? See a full list of FAQs here Opens in a new window.